MILAN/LONDON – Shares in French-Italian automaker Stellantis (NYSE: STLA) resumed their decline on Friday after the carmaker said CEO Carlos Tavares would retire in 2026 and announced wide management changes which failed to lift sentiment.

The moves came after the owner of brands including Peugeot, Fiat, Jeep, and Ram last week cut its 2024 profit forecast, with an estimated cash burn of up to 10 billion euros ($11 billion) this year, and signaled possible reductions to its dividend and share buybacks in 2025.

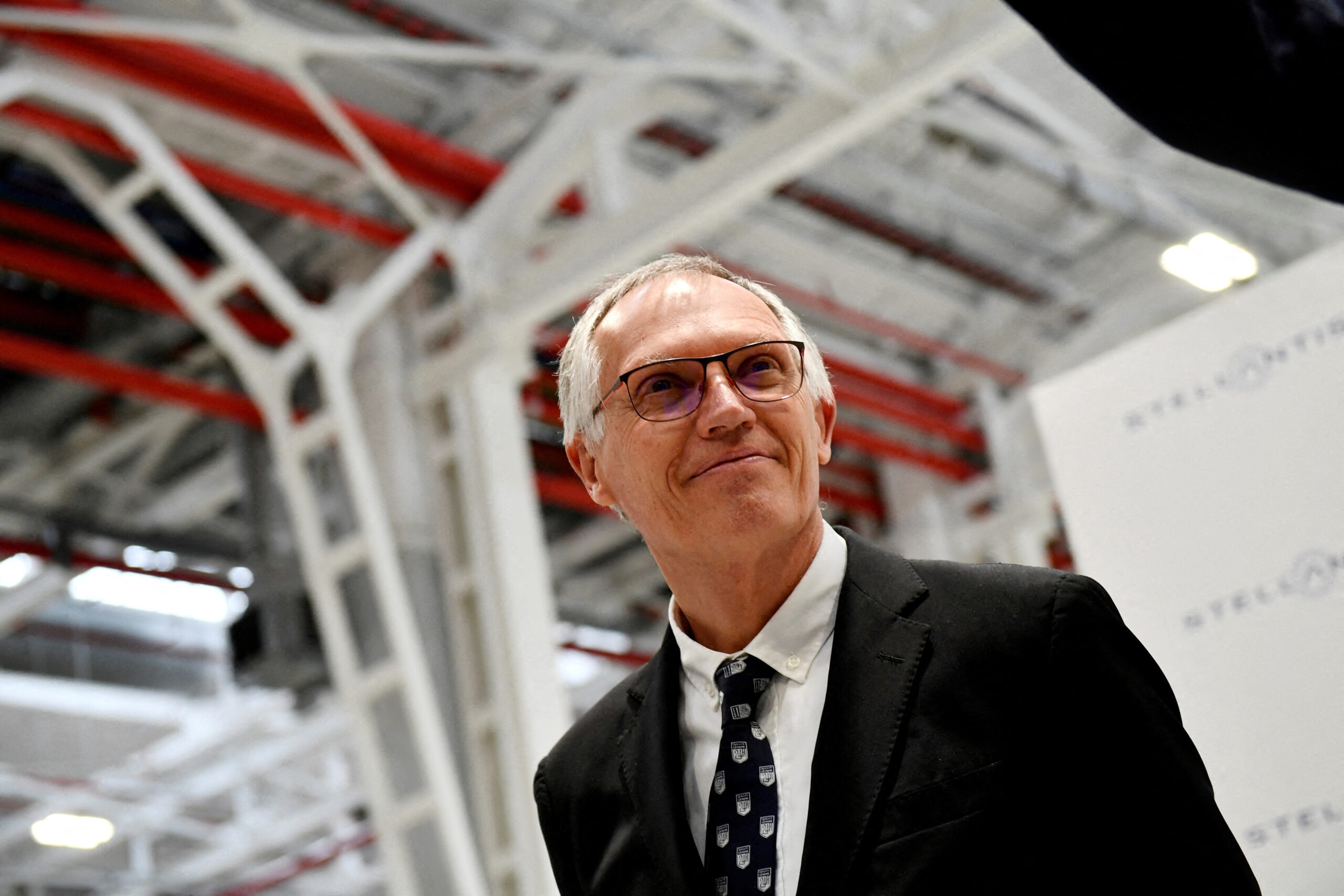

European Union carbon emission rules impose 40% higher costs on the car-making industry at a time when customers are reluctant to buy expensive electric vehicles, and Chinese EV competitors have further cost advantages, Tavares told a parliamentary committee in Rome on Friday.

“This is generating unbearable tension,” he said.

Stellantis’ Milan-listed shares were down 4% at 1447 GMT, their lowest since July 2022.

COMPLACENCY

Fabio Caldato, a portfolio manager at AcomeA SGR, which holds Stellantis shares, said management, after years of success, had been slow to adapt to changes in the market.

“Complacency was their sin,” Caldato said. “They were slow to react to a worsening of the market landscape. That’s why the management reshuffle had to be so deep”.

As part of the reshuffle, Stellantis (NYSE: STLA) replaced its CFO Natalie Knight, who took the position just over a year ago, and the head of its North American business, the group’s profit powerhouse but now at the core of its financial struggles, giving the job to Jeep brand Chief Antonio Filosa.

Knight, who took the position just over a year ago, came under analysts’ criticism for broadly confirming Stellantis’ full-year forecasts only a week before the profit warning.

In a note, RBC analyst Tom Narayan said it was unclear how the management changes would reverse trends around Stellantis’ issues rooted in too-high pricing in North America and high dealer inventories,

“Further, we believe these decisions on top of Mr. Tavares’ retirement in 2026 add more uncertainty for Stellantis’ prospects,” he added.

Chairman John Elkann, Stellantis’ single largest investor through the Agnelli family holding company EXOR, said late on Thursday that Stellantis’ board unanimously backed Tavares, cutting speculation of an early ousting of the CEO.

However, AcomeA’s Caldato said Tavares had achieved outstanding results with Stellantis but this was time for radical change.

“I think the management reshuffle should also have targeted the commander-in-chief,” he said.

Including Friday’s move, the Milan-listed stock has dropped around 45% year-to-date, lagging its European rivals.

“We believe that things may have to get worse before they improve,” brokerage Banca Akros said in a note.

On Friday, Tavares also denied plans to sell facilities in Italy, especially to Chinese competitors, as they will help the group feed future demand for EVs.

“We need all of them,” he told Italian lawmakers.

Confirmation of Tavares’ retirement plans came shortly after Stellantis (NYSE: STLA) said he could remain after his contract expires. The world’s fourth-largest automaker by sales said it now planned to name his successor by the fourth quarter of 2025.

Analysts at JPM said the shake-up provides visibility with regard to the management structure and a clear commitment to find a successor for Carlos Tavares.

Tavares, an avid race car driver who was widely heralded in prior years for making Stellantis one of the world’s most profitable automakers, has led the company since its creation through a 2021 merger between Fiat-Chrysler and Peugeot maker PSA, where he had been board chair since 2014.

($1 = 0.9132 euros)

(Source: ReutersReuters)

Latest News on Stellantis NV (STLA) Stock

Zabih Ullah is a seasoned finance writer with more than ten years of experience. He is highly skilled at analyzing market trends, decoding economic data, and providing insightful commentary on various financial topics. Driven by his curiosity, Zabih stays updated with the latest developments in the finance industry, ensuring that his readers receive timely and relevant news and analysis. Read Full Bio