Apple, the biggest company in the world, was the first to surpass a $1 trillion market capitalization. Apple has seen a 45% increase in its stock price this year, demonstrating its continued supremacy in the world market.

Despite outperforming the Nasdaq Composite ($NASX) with returns of 44% in 2023, Apple (AAPL) stock had an outstanding 49% gain that year. However, it was the least-performing FAANG stock of the year. Sadly, the iPhone manufacturer’s 2024 hasn’t started well either, with three brokerages downgrading the shares in the first two weeks of the year.

So, now the question arises: will this be a good investment for anyone? What will be Apple stock predictions? Should you invest in Apple Stock in 2024? Let’s just focus on that!

History of Apple

Apple has been a technological success story. Apple was founded in the 1970s by Steve Jobs, and now it has become a multinational giant and gained a leading name in this sector. In 1980, the company went public by selling the IPO shares at $22 and estimating the company’s worth to be $1.8 billion.

Following the Lisa PC’s underwhelming performance in the market, Jobs departed Apple in 1985. By the end of 1996, Apple had experienced significant losses and was in a dire situation. Jobs rejoined the business when Apple purchased NeXT in 1996, and in the middle of 1997, he was given his position as CEO back.

For the next 14 years, Jobs led Apple to launch some of the best-selling products and services, which include-

- iMac PC

- iPod MP3 Player

- iTunes Music Store

- Safari Web Browser

- iPhone smartphone

- iPad personal tablet

- iCloud storage

Following a protracted fight with pancreatic cancer, Jobs resigned as CEO in 2011 and passed away. As Tim Cook took over as CEO, he kept driving Apple forward and helped the company’s stock to new heights. To increase the number of installed users across the globe, Apple introduced a range of iPhone models at varying price ranges while Cook was in charge. Apple also turned its attention to higher-margin service products.

Additionally, the business has launched the market’s most aggressive share repurchasing initiative. Apple has repurchased $624.7 billion worth of its stock during the last ten years, significantly more than any other S&P 500 business.

Price of Apple Stock

In 1980, Apple went public with an initial public offering of $22, but it also split up five times in history.

| Stock Split Date | Stock Split |

| June 1987 | 2-for-1 |

| June 2000 | 2-for-1 |

| February 2005 | 2-for-1 |

| June 2014 | 7-for-1 |

| August 2020 | 4-for-1 |

The most recent stock split of the company was a 4-for-1 split in August 2020. A single share of Apple’s IPO stock would be equivalent to 224 shares of Apple stock today if the data for all five of the company’s stock splits were crunched.

Apple’s stock price, split-adjusted, peaked at $1.34 in March 2000, during the tech bubble, but fell to less than 24 cents in October 2002 following the dot-com bubble’s collapse.

In July 2023, Apple achieved a new all-time intraday high of $198.23, split-adjusted.

Things to Know Before Investing in Apple Stock

Undoubtedly, Apple is one of the best-known brands in the world. According to Apple stock news, Apple shares have made a fantastic investment, climbing 817% in the last ten years. However, if you want to buy Apple stock, then you need to think about the following things–

-

Importance of the iPhone

Apple continues to depend heavily on the iPhone while selling a wide range of physical goods, including the iPad, MacBook, AirPods, and Apple Watch. The company’s flagship smartphone brought in almost 52% of revenue during the most recent fiscal year.

From the standpoint of profitability, this is advantageous. Despite making up only 20% of all smartphone shipments worldwide, the iPhone is responsible for around 80% of the industry’s operational profits because of its strong pricing. This contributes to the explanation of Apple’s high level of profitability.

-

Growing Services

It’s not only the hardware items that make Apple a genuinely great company; it’s the whole ecosystem. A major component of this is the expanding services division of the business. This section contains TV+, News, Music, iCloud, and Apple Pay services.

With services accounting for a larger portion of Apple’s sales, this might benefit profitability given the division’s impressive 71% gross margin.

-

Aggressive Share Repurchaser

The company’s operating margin over the last ten years has averaged 27.9%. This isn’t what you expect from a company selling consumer products.

Apple produces a large quantity of free cash flow (FCF). The last three fiscal years accounted for a staggering $304 billion in FCF. Recall that this represents the funds remaining after the company has reinvested in expansion prospects.

-

Expensive Valuation

Even if it is hard to find reasons not to enjoy Apple’s business, value is a crucial factor that should cause investors to hesitate before purchasing the shares.

The price-to-earnings ratio of the shares as of this writing is 29.8. This is much more costly than Apple’s trailing 10-year average of 20.8. Furthermore, it is a significant premium over the S&P 500.

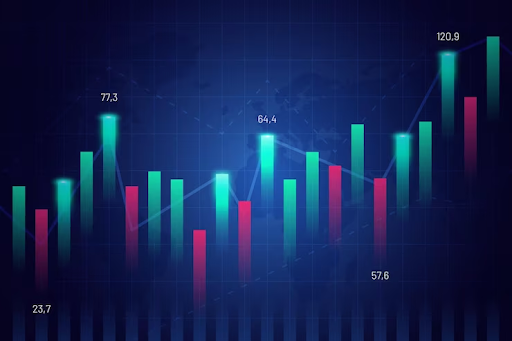

Performance of Apple Stock

In practically every period, Apple stock has shown to be a great buy. Apple has had a cumulative return of more than 60,000% during the last 30 years.

Apple’s stock has returned 225% over the last five years, while the S&P 500 has returned 68% overall. Over the last ten years, Apple has outperformed competitors despite a slowdown in iPhone sales growth, which started in the middle of the decade. Apple’s stock has risen 22% yearly, while the S&P 500 is up 15%.

What Can We Expect in the Coming Years?

Buckle up, Apple enthusiasts; the next few years promise exciting developments and potential stock growth. Here’s a glimpse into what awaits:

- 2024: The year starts with a bang, fueled by a strong Q4 2023 earnings report and initial iPhone 15 sales data. But the real showstopper might be the Vision Pro AR headset. While the success of AR headsets hasn’t been stellar for competitors, Apple’s history of creating new markets with innovative products fuels optimism. Even if initial adoption is slow, Apple’s loyal user base and the potential of AR to revolutionize daily life are positive signs.

Beyond the headset, iPhone sales are expected to grow internationally, and services revenue is upward. These core drivers and potentially lower interest rates should propel the stock price toward $240 by year-end, a significant 32.6% increase.

- 2025: The bullish trend continues. A significant reduction in interest rates is predicted, encouraging investment in stocks, particularly tech giants like Apple. This, combined with the dominance of iPhones among young consumers, could trigger a surge in stock prices. Surveys show a strong preference for iPhones among teenagers, solidifying Apple’s position in the US market for years. These young users, becoming loyal to the Apple ecosystem, will likely contribute to future service revenue through app purchases and cloud storage subscriptions. With these tailwinds, Apple stock forecast for 2025 will reach a cool $290.

- 2030 and Beyond: The crystal ball gets cloudier over time, but the outlook remains optimistic. Apple is expected to penetrate developing countries like India and Africa further while maintaining its grip on younger demographics, guaranteeing a steady stream of service revenue customers. The success of future iterations of the Vision Pro headset could solidify Apple’s dominance in AR/VR. Ventures like integrating Apple’s operating system into electric vehicles also present exciting possibilities. With a projected price of $510 by 2030, Apple is poised to retain its crown as the world’s most valuable company, boasting an $8 trillion market cap.

Remember, Apple’s stock forecast and the future are uncertain. However, considering Apple’s history of innovation, loyal user base, and diverse revenue streams, the coming years seem ripe with opportunities for both the company and its investors.

What Influences the Price of Apple Stock?

Apple’s stock price is a delicate balance influenced by many factors. Here are some key ingredients in this financial cocktail:

-

iPhone Sales

Undoubtedly, iPhone sales remain a major driver. Strong iPhone sales cycles typically translate to a bullish market sentiment, pushing the stock price upwards.

-

Subscription Services

With subscriptions to the App Store, Apple Music, and iCloud included, the Services division represents a sizable and rapidly expanding source of income. Steady growth in this area might boost investor confidence and have a favorable effect on the stock price.

-

New Product Release

New product releases, especially groundbreaking ones, generate significant hype. If the product resonates with consumers, the stock price can experience a surge in anticipation of future success.

-

Interest Rates

Interest rates and general economic conditions play a role. Lower interest rates tend to make stocks more appealing to investors, which might raise Apple’s price. Economic downturns, on the other hand, might stifle investor enthusiasm and cause a fall.

-

Growth in Emerging Markets

Apple’s success in capturing market share in emerging economies like China and India is crucial for future growth. Positive developments in these regions can bolster investor confidence and influence the stock price.

No matter whether you invest in Apple or any other tech stock, one needs to create proper strategies which you can learn here and the things that influence their price.

Should You Invest In It or Not?

Investing in Apple depends on your risk tolerance and investment goals. Apple is a strong company with a loyal customer base and a history of innovation. However, the stock is currently expensive, and iPhone sales growth is slowing. The success of the new AR headset and continued service growth are key factors to consider.

Apple could be a good option if you want a long-term investment with steady growth potential. But do your research and understand the risks before investing.