The world’s largest dialysis specialist Fresenius Medical Care (NYSE: FMS) cut the outlook for volumes in its key U.S. market on Tuesday after revenue from treatments there fell in the second quarter, weighed down by elevated mortality due to COVID-19 and flu among its patients.

The German company expects volumes to be flat or grow by up to 0.5% this year in the U.S., where it makes a bulk of its sales and employs most of its staff, down from the earlier expectations for 0.5% to 2% growth.

The outlook cut follows a 0.3% decline in April-June revenues from U.S. dialysis treatments when adjusted for price effects.

FMC’s shares (NYSE: FMS) dropped 9% to 34.06 euros per share in early trading, their lowest price in five months, and were 7% lower by 0722 GMT.

The company has been hit by excess mortality due to COVID-19 and flu cases among its patients, who are more exposed to these diseases, while persistently high inflation weighs on margins as personnel costs rise and fewer people can afford the expensive treatment.

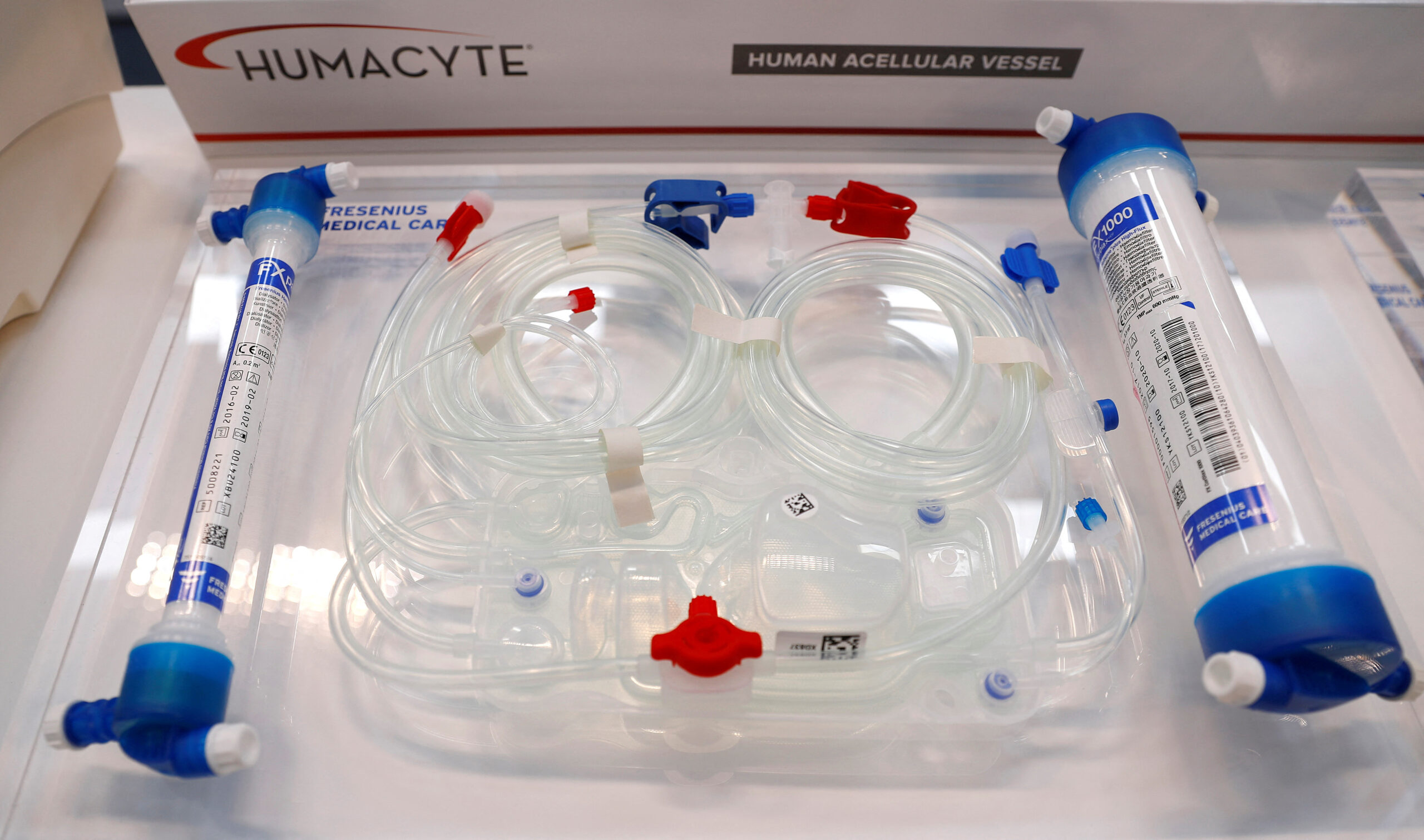

Its revenue and earnings were still in line with market expectations, helped by stronger results in its healthcare products division, which produces dialysis machines, and its FME 25 cost-cutting program.

FMC said its adjusted operating income grew by 8% to 433 million euros ($468.6 million) in the second quarter, matching the median consensus in a Vara Research poll.

The dialysis provider for 332,000 patients worldwide also confirmed its 2024 outlook and medium-term targets.

($1 = 0.9240 euros)

(Source: ReutersReuters)