LONDON – Shares of U.S. and European automakers dropped on Tuesday after President-elect Donald Trump pledged steep tariffs on Canada, Mexico, and China, threatening the industry’s tightly knit supply chains and raising investor concerns of higher costs.

In a post on Truth Social, Trump said he would impose a 25% tariff on all products from Mexico and Canada, and an additional 10% tariff on goods from China, on his first day in office in January.

Many automakers have built factories in Mexico to take advantage of relatively cheap labor and the country’s proximity to the lucrative U.S. market, while China is a supplier of certain key components.

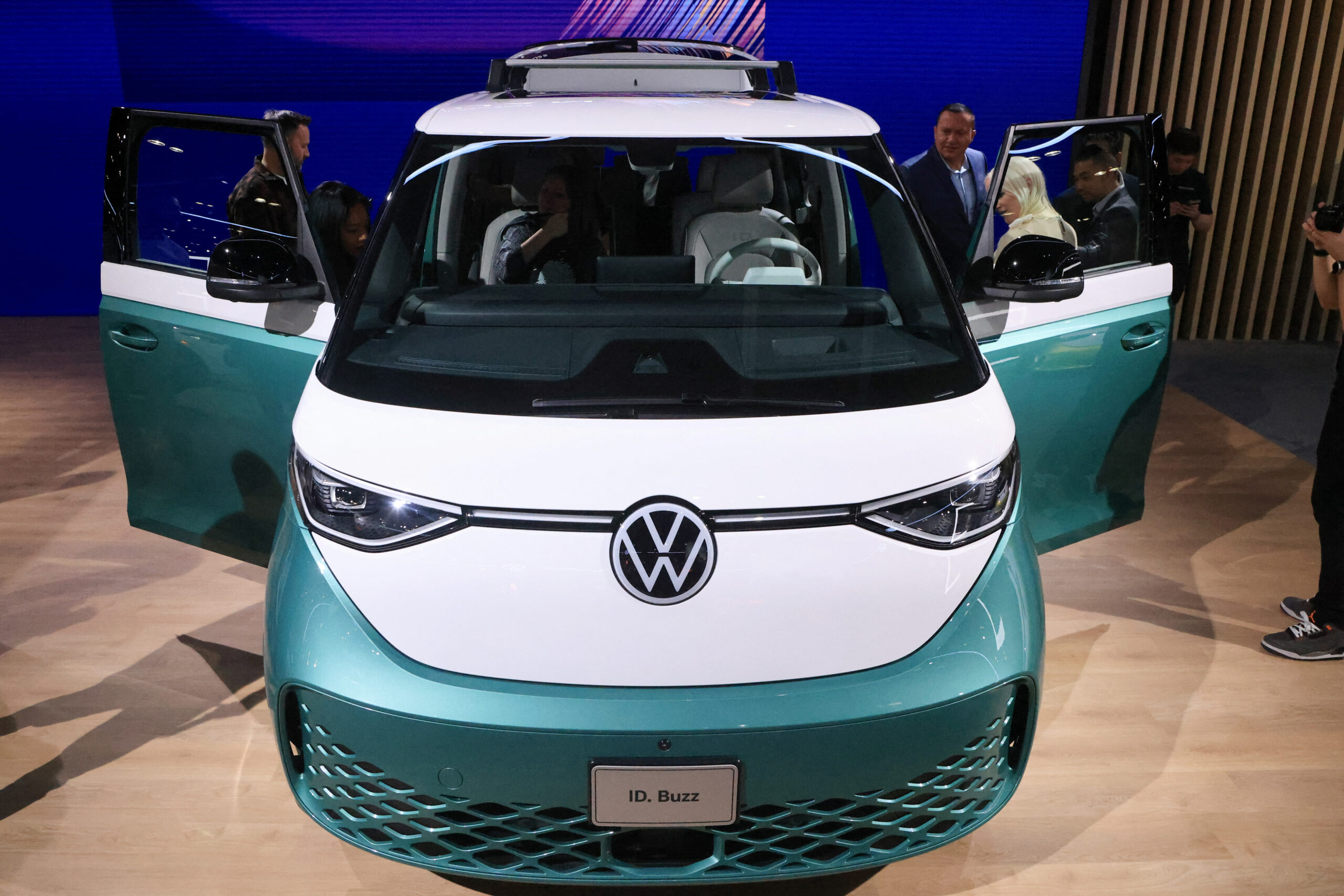

“If implemented, this (tariffs) would spell disaster for the U.S. auto industry and Detroit Three manufacturers, all of whom import significant numbers of vehicles from Canada and Mexico, as well as Volkswagen and other European OEMs,” Bernstein analyst Daniel Roeska said in a note.

“But given the wide-ranging negative implications for industrial production in the U.S., we expect this is unlikely to happen in practice.”

Shares of U.S. automakers General Motors (NYSE: GM) and Ford Motor (NYSE: F) were down 7.5% and 1.7%, respectively. Toyota Motor (NYSE: TM) shares were down 1.7%.

Among European automakers, Jeep maker Stellantis and Volkswagen were down about 4% and 2%. A basket of autos and parts stocks was the worst-performing sector in Europe, down about 1.8% versus a 0.6% fall for the broader STOXX 600.

Stellantis and Ford declined to comment on Trump’s post, while rivals GM and Toyota did not immediately respond to requests for comment.

Last week, GM CFO Paul Jacobson said the automaker had some assets in Mexico.

“We’re going to continue to work with the administration because I think our goal is very consistent with what the administration’s goal is in terms of U.S. jobs and what that can mean,” he told a Barclays conference when asked about potential tariffs.

Ford CFO John Lawler said last week the automaker would have to see what level of tariffs were imposed and decide on pricing.

In a note published last week, Evercore ISI said every 10% tariff on Mexico is a 20% earnings-per-share risk for GM, and 10% for Ford.

“We estimate that each extra 1pp on tariff could impact pre-tax profit by ~Eu160mn or 1.4% of 2025 expectations,” Italian broker Intermonte said on Stellantis.

About a quarter of vehicles sold by Stellantis in North America are made in Mexico.

Canadian auto supplier Magna International (NYSE: MGA) shares fell 3%, while peers Aptiv (NYSE: APTV) and BorgWarner (NYSE: BWA) fell about 2% each.

“We view the tariff threats as more of a negotiating tactic to get the other countries to make concessions on various other issues such as illegal immigration,” said CFRA Research analyst Garrett Nelson.

Kevin Putnam is a financial journalist and editor based in New York. He specializes in editing news and analysis related to U.S. stock market. Read Full Bio