U.S. pharmaceutical industry middlemen defended their role in the healthcare system during a Congressional hearing on Tuesday after committee members accused them of pushing patients toward expensive treatments even when lower-cost options are available.

A House Committee on Oversight and Accountability report released earlier on Tuesday said it found evidence that these pharmacy benefit managers force drugmakers to pay rebates for placing their branded drugs in a favorable position on their lists of medications covered by various insurance plans.

In testimony before the committee, executives from the top three U.S. drug benefit managers – UnitedHealth’s OptumRx, Cigna’s ExpressScripts, and CVS Health’s Caremark – said their business models save health plan members money, including plans run by labor unions.

They blamed “patent abuses” by drug manufacturers that delay launches of cheaper generic and biosimilar medicines for the heightened costs to consumers. The launch price of new drugs was also an issue, they said.

Pharmaceutical executives, in turn, have repeatedly said the PBMs are to blame for high prescription drug costs.

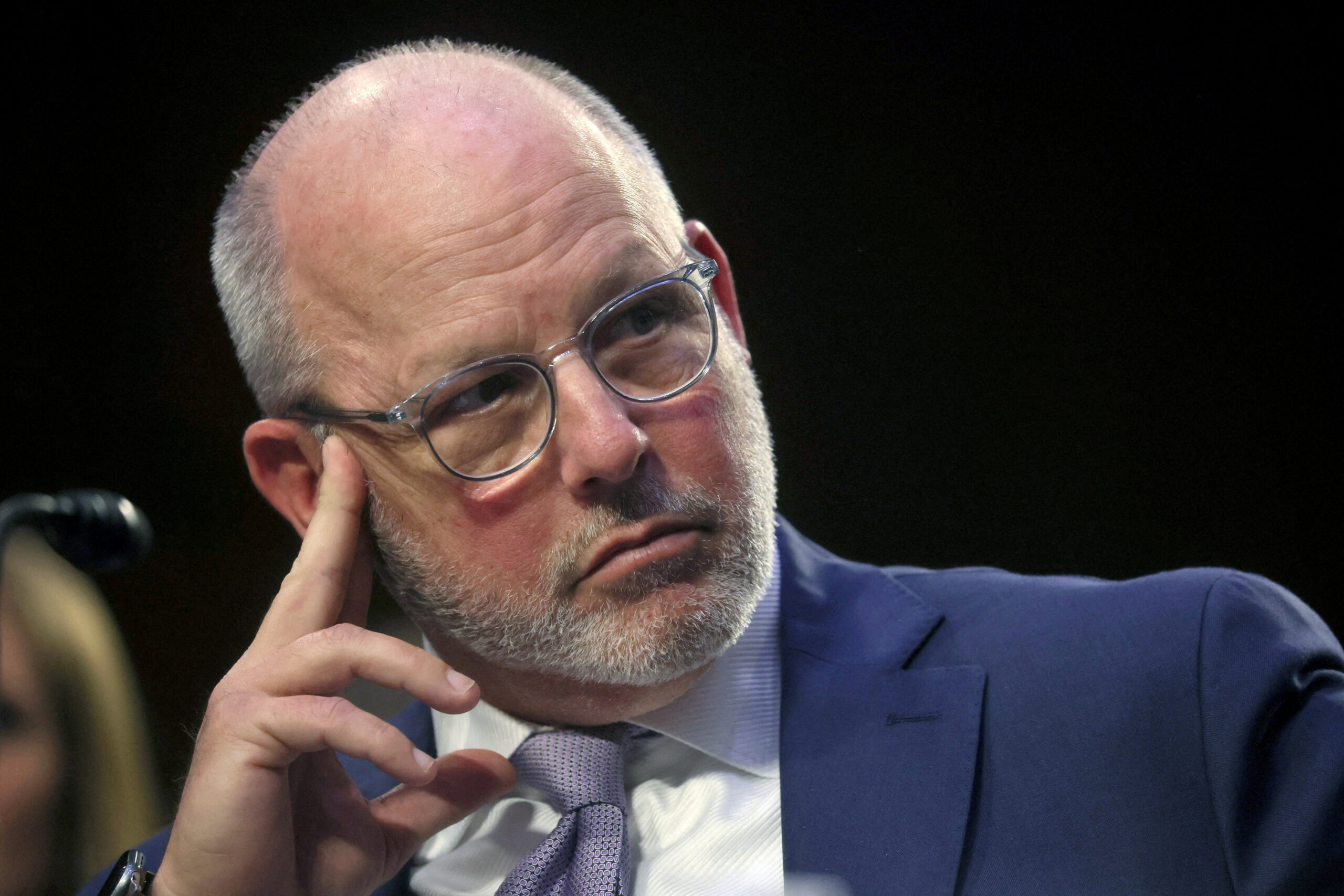

CVS Caremark President David Joyner, however, told the committee that last year a new-to-market drug carried a median annual price of $300,000.

“Humira, Ozempic, and Stelara alone cost more than every generic drug combined,” he said of AbbVie’s top-selling arthritis treatment, Novo Nordisk’s (NYSE: NVO) diabetes drug widely used off-label for weight loss, Johnson & Johnson’s (NYSE: JNJ) blockbuster Crohn’s disease treatment.

Joyner described the price of GLP-1 drugs used for weight loss as “overwhelming,” adding costs would surpass 1.2 trillion dollars annually if all obese people received one.

Novo’s Ozempic and Wegovy and Eli Lilly’s (NYSE: LLY) Mounjaro drove more than two-thirds of the increased costs for Caremark customers in 2023, according to Joyner.

Committee Chair James Comer, a Republican, accused PBMs of shifting responsibility for drug pricing onto manufacturers.

“That’s not what we hear from doctors all across America. That’s not what we hear from pharmacists all across America,” Comer said.

Pharmacy benefit managers handle prescription drug benefits for health insurance companies, large employers, and Medicare prescription drug plans.

Those businesses at CVS (NYSE: CVS), UnitedHealth (NYSE: UNH), and Cigna (NYSE: CI) control 80% of prescription drugs dispensed in the U.S., according to Representative Jamie Raskin, a Democrat.

The three largest intermediaries have used their position “to enact anti-competitive policies” and protect their profits, the committee said in its report.

It also said that healthcare companies share patient data among business units to steer patients toward pharmacies they own.

The report said that the companies have also begun moving some operations abroad to avoid transparency and proposed reforms.

(Source: ReutersReuters)