The lesser-known Chinese electric vehicle contender confronts a challenging journey in the coming decades. Let’s explore what will NIO stock be worth in 10 years.

Current Price |

$ 5.58 |

| Price Prediction | $ 6.08 (9.01%) |

| Fear & Greed Index | 39 (Fear) |

| Sentiment | Bearish |

| Volatility | 4.19% |

| Green Days | 15/30 (50%) |

| 50-Day SMA | $ 6.19 |

| 200-Day SMA | $ 8.58 |

| 14-Day RSI | 48.40 |

As per our latest NIO stock prediction, we anticipate a 9.01% increase in the value of NIO Inc. shares, reaching $6.08 per share by March 21, 2024. Our technical indicators suggest a current bearish sentiment, with the Fear & Greed Index displaying a reading of 39 (Fear). Over the past 30 days, NIO stock has experienced 15 out of 30 (50%) green days, with a price volatility of 4.19%. Considering our forecast, NIO Inc. stock appears to be trading at a favorable position, currently standing 8.26% below our projected value, making it an opportune time for investment.

Since its initial public offering (IPO), NIO has presented a volatile journey for investors interested in the future worth of NIO stock in 10 years. This Chinese electric vehicle (EV) manufacturer made its market debut at $6.28 per American depositary share (ADS) on September 12, 2018. NIO’s stock skyrocketed to an extraordinary peak of $62.84 on February 9, 2021. At its highest point, NIO boasted an enterprise value of $91.4 billion, which amounted to 16 times its projected 2021 sales, signaling immense potential for growth and speculation regarding its future valuation.

At present, NIO is trading at approximately $6 per share, carrying an enterprise value of $12.1 billion, slightly surpassing 1 time the anticipated sales for 2024. Let’s delve into the reasons behind this EV stock’s return to its IPO price, assess whether it represents a bargain at this stage, and explore its potential to evolve into a trillion-dollar EV manufacturer in the coming decades.

Despite the optimism from numerous individual investors and a portion of analysts endorsing the Chinese electric vehicle (EV) enterprise NIO, the company has fallen short of anticipated performance. Following declines in 2021 and 2022, it experienced a further setback in 2023, with its market capitalization decreasing by nearly one-fifth. This trajectory suggests it is poised for its third consecutive year of financial losses.

NIO once celebrated as the “Tesla of China” finds itself grappling to uphold that reputation. At the same time, BYD, a Chinese company, appears poised to claim the title of the largest electric vehicle (EV) seller from Tesla. BYD has already surpassed Tesla in total deliveries, factoring in pure electric and plug-in hybrid vehicles (PHEVs).

Certain optimistic investors in NIO anticipate its stock climbing to $100 in the long run, with an exceedingly small group speculating it could even reach $1,000. However, the forecast for NIO in 2030 suggests that the likelihood of it reaching $100 by then appears unlikely.

The operational framework of NIO

Electric vehicle (EV) companies typically follow one of two business models. The first model involves self-manufacturing, which is employed by companies such as Tesla, Rivian (RIVN), and Lucid Motors (LCID). Although this approach requires significant capital investment, it highlights the emphasis these companies place on manufacturing, a fundamental aspect that many argue has traditionally defined the core business of automotive companies.

The alternative approach is contract manufacturing, embraced by NIO and certain other companies like Fisker (FSR). Advocates of this model argue that similar to smartphone companies, automotive firms can delegate manufacturing to third parties while concentrating on design and software development. Interestingly, Foxconn, a major producer of Apple’s (AAPL) products, has ventured into automotive contract manufacturing and established a joint venture with Saudi Arabia to produce electric vehicles in the oil-rich nation.

Each strategy carries its advantages and disadvantages. While self-manufacturing offers greater control over the production process and supply chain, third-party manufacturing provides access to manufacturing expertise, which is often lacking in startup EV companies.

At present, NIO relies on China’s state-owned JAC Motors for car production. Nonetheless, there are indications that NIO is planning to acquire the facility from JAC to achieve manufacturing autonomy. Morgan Stanley asserts that purchasing the plants from JAC would be strategically beneficial for NIO.

NIO has established an extensive network of battery-swapping stations across China. Additionally, it offers a subscription-based model for batteries, allowing for reduced car prices for customers while generating recurring revenue through subscription fees. To moderate its cash burn rate, NIO has ceased offering free battery swaps for new purchasers.

NIO stock price stood at $5.58

According to the latest long-term forecast, NIO price will hit $8 by the end of 2025 and then $12 by the end of 2026. NIO will rise to $15 within the year 2028, $17 in 2029, and $20 in 2032.

| Year | Mid-Year | Year-End | Tod/End, % |

| 2024 | $6.19 | $6.81 | +22% |

| 2025 | $7.52 | $8.96 | +61% |

| 2026 | $10.57 | $12.06 | +116% |

| 2027 | $12.85 | $12.86 | +130% |

| 2028 | $14.15 | $15.42 | +176% |

| 2029 | $16.68 | $17.93 | +221% |

| 2030 | $18.16 | $18.53 | +232% |

| 2031 | $18.92 | $19.33 | +246% |

| 2032 | $19.75 | $20.19 | +262% |

| 2033 | $20.65 | $21.14 | +279% |

| 2034 | $21.65 | $22.18 | +297% |

| 2035 | $22.74 | $23.33 | +318% |

NIO Stock Price Forecast 2024-2025

The NIO stock commenced in the year 2024 at $9.07. As of today, it is trading at $5.58, marking a decrease of -38% since the beginning of the year. The projected price for NIO by the end of 2024 is $6.81, reflecting a year-to-year change of -25%. The anticipated rise from current levels to year-end is +22%. By mid-2024, it is expected to reach $6.19. During the first half of 2025, the NIO price is forecasted to increase to $7.52, followed by an additional $1.44 climb in the second half, closing the year at $8.96, representing a +61% increase from the current price.

The short-term forecast:

- Monday, Mar 18 – $5.60

- Tuesday, Mar 19 – $5.60

- Wednesday, Mar 20 – $5.61

- Thursday, Mar 21 – $5.61

- Friday, Mar 22 – $5.62

- April 15 – $5.76

- May 15 – $5.93

- June 15 – $6.10

- July 15 – $6.24

- August 15 – $6.35

NIO Stock Forecast 2026-2030

Over the next five years, there is projected to be a substantial surge, the NIO price is expected to rise from $8.96 to $18.53, representing a 107% increase. NIO’s valuation will commence at $8.96 in 2026, then escalate to $10.57 in the initial half of the year, concluding at $12.06 by year-end. This translates to a +116% increase from the current value.

Although several of the existing startup EV firms may not endure until 2030, there’s a strong likelihood that NIO will weather the current downturn. Nevertheless, its prospects hinge on the performance of its forthcoming models, the ability to sustain profitability and generate free cash flows, as well as the feasibility of its planned global expansion, which has become notably more complex compared to previous quarters.

For example, although NIO aims to penetrate the U.S. market by 2025, it could face challenges in the world’s most profitable automotive market due to tax credit regulations that do not extend to its vehicles imported from China. As electric vehicle consumers become more price-sensitive, the lack of a $7,500 EV tax credit may hinder NIO’s potential in the U.S. market.

Furthermore, as NIO gears up for potential expansion into new markets, such as the United States and Europe, the uncertainty surrounding its long-term stock value becomes more pronounced. With investors pondering ‘what will NIO stock be worth in 10 years, factors such as geopolitical tensions, regulatory hurdles, and global economic shifts come into play. Navigating these challenges while maintaining profitability and market competitiveness will be crucial for NIO’s sustained growth. In the increasingly competitive landscape of electric vehicle (EV) manufacturing, establishing a strong foothold in key markets and adapting its business model to align with evolving industry dynamics will be essential for NIO’s success in the coming decade.

NIO Stock Forecast 2031-2035

During this timeframe, the value of NIO is expected to increase from $18.53 to $23.33, marking a rise of +26%. NIO is projected to commence 2031 at $18.53, then rise to $18.92 within the first six months of the year, and conclude 2031 at $19.33, representing a growth of approximately +246% from its current value.

The primary obstacles encountered by NIO

NIO offers an extensive lineup of electric sedans and SUVs, with its most affordable models priced at approximately $46,000. Delivering its initial vehicles in 2018, the company has experienced remarkable growth in deliveries over the subsequent five years.

| METRIC | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Deliveries | 11,348 | 20,565 | 43,728 | 91,429 | 122,486 | 160,038 |

| Growth | –* | 81% | 113% | 109% | 34% | 31% |

DATA SOURCE: NIO. *DELIVERIES STARTED IN 2018.

However, NIO experienced a slowdown in deliveries during 2022 and 2023 due to challenges related to supply chain limitations, macroeconomic factors, and intensified competition within China’s electric vehicle (EV) sector, particularly driven by Tesla’s aggressive price reductions. Consequently, this pressure led to a decline in vehicle margins from a high of 20.1% to a mere 11% by the third quarter of 2023.

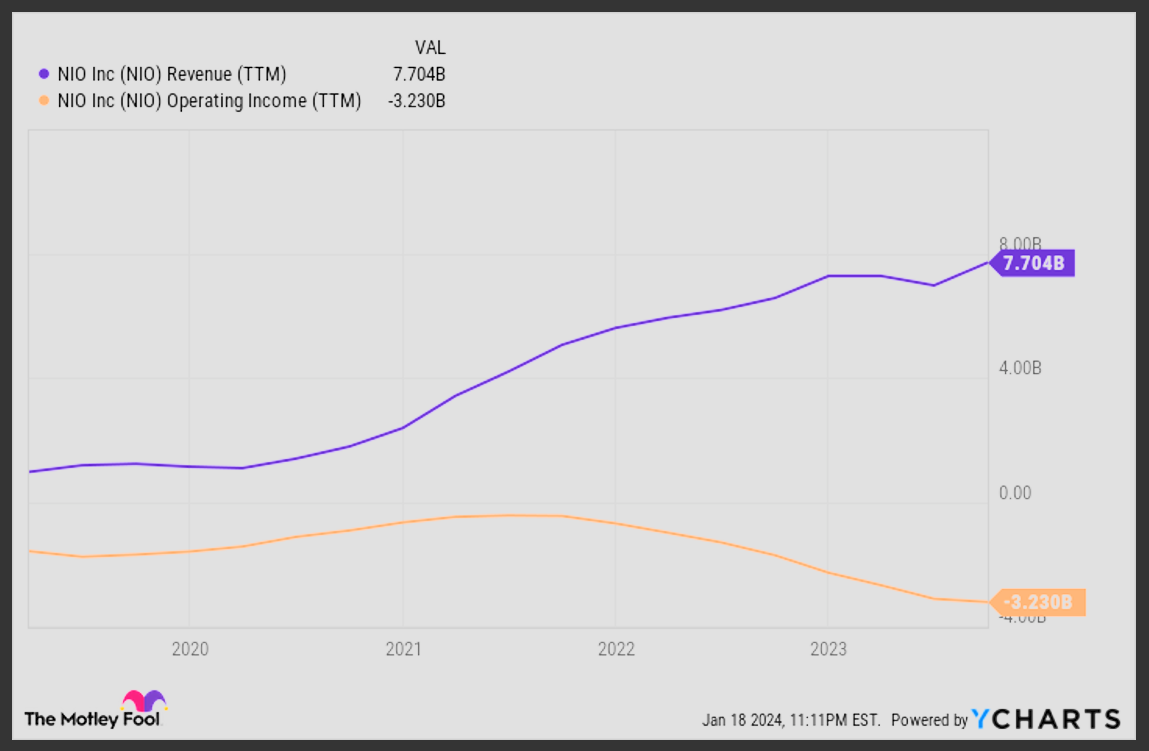

As NIO’s vehicle margins contracted, the company persisted in growing its battery-swapping station network, allowing its customers to exchange useless batteries for fully charged ones. This distinctive feature sets NIO’s vehicles apart from competitors, yet the substantial expenses associated with building these networks led to significant operating losses.

From 2018 to 2021, NIO showed improvement in its operating margin, progressing from a negative 180.1% to a negative 12.4%, sparking optimism for eventual profitability. However, this figure declined to negative 27.1% in 2022 with analysts projecting a negative operating margin of 35.2% for 2023, expected to be announced in late February or early March.

Analysts anticipate a 13% increase in NIO’s revenue to 55.6 billion yuan ($7.8 billion) for the full year, alongside a widening net loss from 14.6 billion yuan ($2.1 billion) to 18.6 billion yuan ($2.6 billion).

This outlook appears miserable for a company that concluded its latest quarter with a high debt-to-equity ratio of 5.2, especially when compared to Tesla, which boasts firm profitability and a significantly lower debt-to-equity ratio of 0.7. NIO’s persistent losses and high leverage may impede its growth potential, particularly as long as interest rates remain elevated.

The numerical route to reaching $1 trillion

In an optimistic scenario, NIO may see a gradual stabilization in its deliveries and margins with the realization of economies of scale. Improved diplomatic relations between the U.S. and China could also reignite investor confidence in U.S.-listed Chinese stocks, while successful expansion into European and other international markets could further boost its prospects.

Under these circumstances, there’s a possibility that the market may begin to value NIO more comparably to Tesla, which currently commands a valuation of 6 times its 2024 sales. Assuming NIO achieves a similar valuation and sustains a compound annual growth rate (CAGR) of 12%, growing its revenue from $7.8 billion in 2023 to $166.7 billion by 2050, the company could potentially attain a valuation of $1 trillion by the end of that year.

NYSE: NIO

NIO

Today’s Change

(-5.74%) -$0.34

Current Price

$5.58

NIO

KEY DATA POINTS

Market Cap

$9B

Day’s Range

$5.54 – $5.82

52wk Range

$4.78 – $16.18

Volume

191,853

Avg Vol

63,479,314

Gross Margin

5.42%

Dividend Yield

N/A

However, achieving this goal is quite ambitious as it would surpass the current size of Tesla, which is projected to generate $117 billion in revenue by 2024. It also presupposes that NIO can continue to distinguish itself and sustain growth in a crowded market.

Should NIO overcome these challenges, it could potentially become a member of the trillion-dollar valuation club. However, with over 200 electric vehicle manufacturers, including industry heavyweights like Xiaomi and Huawei, competing for market share in China’s competitive landscape, the rapid commoditization of the sector may eliminate unprofitable contenders like NIO.

NIO Is Not Facing Bankruptcy

In the first quarter of 2020, concerns emerged regarding NIO’s potential insolvency and bankruptcy. However, the company managed to secure funding from strategic investors, with additional support from the Chinese government to rescue the struggling firm.

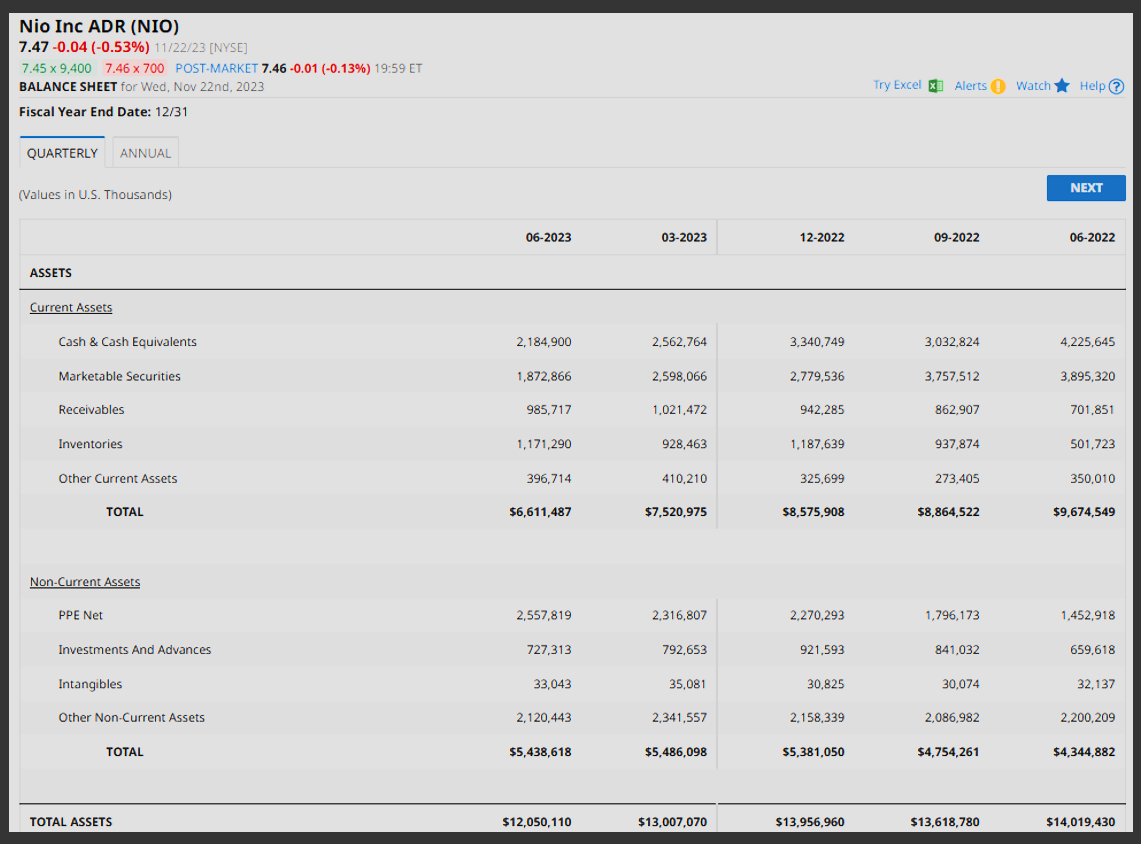

Subsequently, NIO has raised capital on multiple occasions through various means, including a $740 million strategic investment from CYVN Holdings, predominantly owned by the Abu Dhabi government. As of June, the company held $4.3 billion in cash and cash equivalents on its balance sheet, demonstrating its ability to attract investment from diverse sources. Against the backdrop of the current downturn in the electric vehicle industry, a robust balance sheet assumes paramount importance, ensuring financial stability amid macroeconomic challenges.

NIO’s President and co-founder, Lihong Qin, wanted to reassure concerns regarding the company’s viability, affirming at this year’s Guangzhou Auto Show that “NIO will not face closure, and there is no chance of it going out of business.” However, the company has taken a cautious approach to expansion and has downsized its workforce by 10% due to growth rates falling short of expectations.

Is NIO Stock Expected to Reach $100 by 2030?

Currently, NIO’s stock is priced below $8, with a market capitalization of approximately $12.8 billion. In February 2021, NIO’s market cap nearly touched $100 billion at its peak. However, those were different circumstances, and for electric vehicle companies operating at a loss, it almost feels like a different era altogether.

Achieving a price of $100 by 2030 would necessitate NIO stock to grow at a compound annual growth rate (CAGR) of over 40%, resulting in a 13.4-fold increase from its current levels, equating to a market capitalization of $180 billion. However, from a realistic standpoint, I do not anticipate NIO stock reaching $100 by 2030, despite its current undervalued status making it an electric vehicle stock worth evaluating.

Explore beyond NIO’s market capitalization

NIO’s drawback threat may be contained at these levels, but its stock might stay standing around its IPO cost until it accelerates its conveyances and contracts its working misfortunes once more. Therefore, instead of solely focusing on NIO’s potential to achieve a trillion-dollar valuation in the electric vehicle (EV) industry over the next decade, investors should keep an eye out for signs of growth that could drive meaningful appreciation in the NIO stock worth in 10 years.

Would it be advantageous to assign $1,000 towards investing in NIO at this moment?

Thinking about putting $1,000 into NIO right now? Well, it’s a bit of a toss-up. NIO’s been on the rise lately, with its electric vehicles gaining traction and all. But the stock market can be a wild ride, you know? It’s alike sometimes to forecasting the weather you’re accurate, and sometimes you’re not. Before diving in, it’s smart to do your homework, see what the experts are saying, and trust your instincts. After all, investing is all about taking calculated risks. So, while there might be potential, it’s wise to weigh your options carefully before making any moves.

You can also check the Top 10 Best Tech Stocks for 2024 Growth on our site, which they recommend investors consider at present. Notably, NIO did not make it onto this list. The chosen 10 stocks are anticipated to potentially deliver substantial returns in the years to come.

Conclusion

As we peer into the crystal ball of the stock market, predicting the future of NIO stock remains an exercise in uncertainty. While the company’s innovative approach to electric vehicle manufacturing and its growing market presence may bode well for its long-term prospects, investors must approach with caution, mindful of the inherent risks and volatility of the stock market. Navigating the uncertainty requires a steady hand, informed decision-making, and a willingness to weather the storms that lie ahead.

Junaid Altaf is a content writer and journalist who loves exploring stocks. He Analyzes stocks of different companies to make the news simple and interesting for everyone to understand.